Sep 03, · Among the top IPO stocks to buy and watch, SEO leader Semrush is breaking out past a new buy point and is out of buy range Aug 23, · Among the top stocks to buy and watch, chip leader Nvidia is breaking out today past a new buy point. Snap is also in buy range Starting a business from scratch can be challenging. Franchising or buying an existing business can simplify the initial planning process. Buy an existing business or franchise

Buy an existing business or franchise

Important legal information about the email you will be sending. By using this service, you agree to input buy out business plan real email address buy out business plan only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity.

com: ", buy out business plan. Adequate planning can ensure your business will be preserved as you want it to be. If you have your own business, you may wish to keep the business within your family or sell it, before or after you pass away.

Regardless of which option you choose, careful planning will ensure the business can stay up and running and be protected from large, unexpected tax liabilities. YES, all assets, including business assets, generally must go through probate unless the assets allow for the naming of beneficiaries. However, certain trusts GRATs or GRUTs can be established during your lifetime that will allow any subsequent growth of the trust assets to pass outside of your taxable estate, buy out business plan.

It's important to understand that the value of your buy out business plan may continue to grow between the time you buy out business plan your estate and when you pass away, and that the taxable estate will include the value as of your date of death. If your business has one or more co-owners, buy out business plan, you might consider establishing an agreement that upon the death of any owner, their interest is buy out business plan purchased by the other owner s.

Known as a buy-sell agreementthis arrangement can ensure that beneficiaries of the deceased owner including spouses or other family members don't unintentionally become owners. Life insurance can be purchased or an irrevocable life insurance trust ILIT can be established to cover these buy-sell agreements and provide necessary liquidity.

At a minimum, a business succession plan should address the systematic transfer of the management and ownership of a business. The gap between what your business is worth while you plan your estate and what it is worth when you pass away, as well as other liquidity problems, may be managed by creating an ILIT.

If the ILIT is structured correctly, buy out business plan, the benefits paid from the underlying insurance policy do not pass through probate and are available immediately, providing cash for estate taxes and other needs. You may be able to transfer your business assets to your children and retain a source of income for yourself by establishing a grantor retained annuity trust GRAT or grantor retained unitrust GRUT.

If the assets grow over the terms of the trust, the buy out business plan will not be subject to estate taxes, so these trusts can be effective tools for passing on a rapidly growing business. To achieve the estate tax benefits of this type of trust, the trust must be structured precisely and you must outlive the terms of the trust, buy out business plan.

You may mitigate this risk by structuring an ILIT for wealth replacement to help offset the potential tax liability that would occur if you die before the trust buy out business plan. Another approach is the family limited partnership or a family limited liability company.

For example, you can form a limited partnership to hold the business assets. Some of the limited partnership units can be transferred to your successors, potentially eliminating the units from your taxable estate. Because limited partnership interests do not carry control of the partnership, the value of the transferred assets may be discounted for gift tax purposes. As with GRATs and GRUTs, family limited partnerships are subject to complex rules and it is advisable to consult with experienced tax and estate planning professionals.

Personal Trust Services. COVID layoffs: How to rebuild. Top 5 estate planning questions. The tax information and estate planning information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice. Fidelity does not provide legal or tax advice. Fidelity cannot guarantee that such information is accurate, complete, or timely.

Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of such information. Federal and state laws and regulations are complex and are subject to change.

Fidelity makes no warranties with regard to such information or results obtained by its use. Fidelity disclaims any liability arising out of your use of, buy out business plan, or any tax position taken in reliance on, such information. Always consult an attorney or tax professional regarding your specific legal or tax situation.

irrevocable trust that pays a fixed annuity to the grantor for a defined term, with the remainder of the trust passing to a noncharitable beneficiary.

Estate Planning and Inheritance Glossary. trust that pays a fixed percentage back to the donor for a period of time; designed for the transfer of business or property assets and shifts future appreciation to children through the use of gift tax rather than estate tax. for business with multiple owners; legal contract that stipulates the terms for remaining owners to purchase the interest of one that is departing. partnership arrangement designed for the transfer of business, property, or other assets between family members, often from parents to children, buy out business plan, in an effort to minimize estate tax liability and possibly provide protection from creditors.

entity designed for the transfer of a business, property, or other assets from parents to children to minimize estate tax liability and possibly provide protection from creditors. Skip to Main Content. com Home. Customer Service Profile Open an Account Virtual Assistant Opens in a new window Log In Customer Service Profile Open an Account Virtual Assistant Opens in a new window Log Out. Search fidelity. com or get a quote. What We Offer Create Your Financial Plan My Goals Financial Basics Building Savings Robo Investing Plus Financial Advice Wealth Management Find an advisor Retirement Life Events.

Investment Products. Why Fidelity. Print Email Email. Send to Separate multiple email addresses with commas Buy out business plan enter a valid email address. Your email address Please enter a valid email address. Message Optional. Estate Planning Overview. Succession Planning for a Business Adequate planning can ensure your business will be preserved as you want it to be.

Does a business you own go through probate? What we offer Personal Trust Services. From our experts 5 reasons to start tax prep COVID layoffs: How to rebuild Top 5 estate planning questions. Stay Connected Locate an Investor Center by ZIP Code. Please enter a valid ZIP code. Instagram LinkedIn YouTube Reddit Twitter Facebook Fidelity Mobile ® Refer a Friend. Careers News Releases About Fidelity International.

Copyright FMR LLC. All Rights Reserved. Terms of Use Privacy Security Site Map Accessibility Contact Us Share Your Screen Disclosures This is for persons in the US only. close grantor retained annuity trust GRAT irrevocable trust that pays a fixed annuity to the grantor for a defined term, with the remainder of the trust passing to a noncharitable beneficiary Estate Planning and Inheritance Glossary.

close grantor retained unitrust GRUT trust that pays a fixed percentage back to the donor for a period of time; designed buy out business plan the transfer of business or property assets and shifts future appreciation to children through the use of gift tax rather than estate tax Estate Planning and Inheritance Glossary.

close buy-sell agreement for business with multiple owners; legal contract that stipulates the terms for remaining owners to purchase the interest of one that is departing Estate Planning and Inheritance Glossary. close family limited partnership partnership arrangement designed for the transfer of business, property, or other assets between family members, often from parents to children, in an effort to minimize estate tax liability and possibly provide protection from creditors Estate Planning and Inheritance Glossary.

close family limited liability company entity designed for the transfer of a business, property, or other assets from parents to children to minimize estate tax liability and possibly provide protection from creditors Estate Planning and Inheritance Glossary.

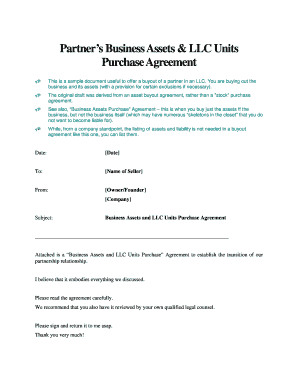

Creating a Business Buyout Plan

, time: 1:58Prudential in talks to buy out and shut coal-fired plants in Asia | Coal | The Guardian

Main local company number included for online purchases. 1 PLUS try Vonage Business Communications free for 14 days if you buy online (up to 99 lines)! 2 Pricing starts as low as $ (plus taxes and fees).* Aug 03, · Prudential in talks to buy out and shut coal-fired plants in Asia This article is more than 1 month old Scheme with Asian Development Bank could Sep 03, · Among the top IPO stocks to buy and watch, SEO leader Semrush is breaking out past a new buy point and is out of buy range

No comments:

Post a Comment